AML/CFT Compliance Guidance Services in the UAE

Federal Decree No. (20) of 2018 serves as a key foundation for the UAE’s efforts in combating money laundering and the financing of terrorism (AML/CFT). This Decree mandated the creation of

As implemented by Cabinet Decision No. (10) of 2019, Federal Decree No. (20) of 2018 has raised the effectiveness of the AML/CFT legal and institutional framework of the nation, in line with FATF requirements and recommendations.

The reporting and compliance under this Regulation have gained momentum with the introduction of the new GoAML Platform and strict guidelines from the Regulator.

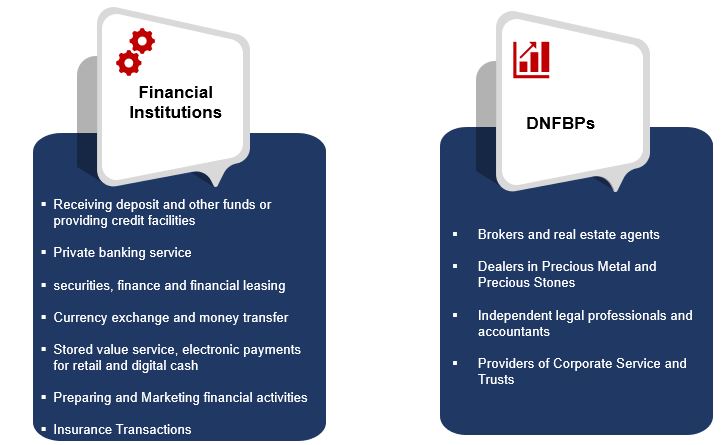

It is mandatory for the following specified businesses to comply with the Regulations.

Emirates Chartered Accountants Group[ECAG] – AML/CFT Compliance and Certification Services Dubai, UAE.

Failure to adapt to evolving requirements can result in penalties and legal repercussions.

An effective framework should be developed in accordance with the regulator’s guidelines, ensuring compliance with Federal Law 20 of 2018, as amended by Federal Law 26 of 2021. This framework should also adhere to Cabinet Decision No. 10 of 2019, Cabinet Decision No. 58 of 2020, Cabinet Decision No. 74 of 2020, and the various guidelines, circulars, notices, and standards issued periodically.

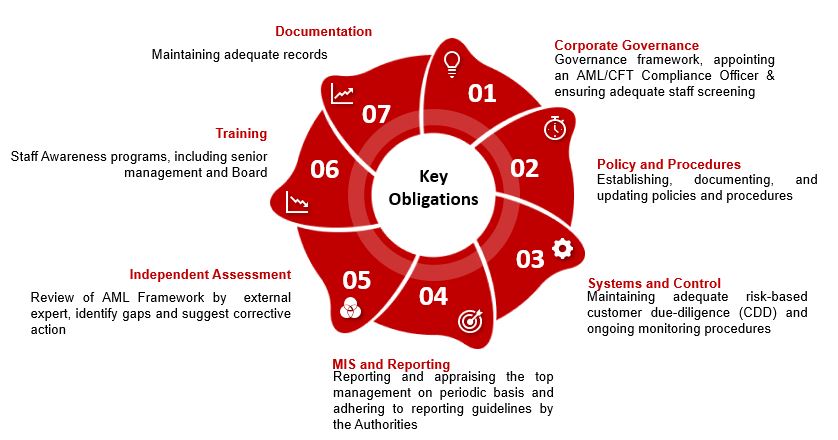

The foundational pillars that support the development of an effective AML/CFT Compliance Program can be categorized as follows:

The expert team at Emirates Chartered Accountants Group can assist in developing, implementing, and enhancing compliance frameworks across various sectors, including Designated Non-Financial Businesses and Professions (DNFBP), banking, insurance, exchange houses, and more.

To ensure clients progress financially and socially.

Contact us today to schedule a consultation and learn how our corporate tax services can benefit your business.

“Empowering Lives Through Wisdom”

Our goal is to impact the lives we touch, not just with our knowledge, but through the wisdom we’ve gained.

We will use our life experiences to enhance the lives of others, earning their trust and respect along the way.

UAE Mainland

Mainland Dubai

UAE Free Zones

Meydan Freezone

RAKEZ Freezone

IFZA Freezone

“All content and design on this website are protected by copyright laws. Unauthorized use or reproduction of any content, including but not limited to text, images, and design elements, is strictly prohibited. Any infringement will be pursued legally under UAE/International law. Replicating or utilizing this content for commercial or competitive purposes without explicit permission constitutes a violation and will result in legal action.

Copyright © STH FINANCIAL SERVICES (FZE). All Rights Reserved.

“

You cannot copy content of this page