Why Corporate Tax Registration Deadline Matters

The introduction of corporate tax in the UAE in June 2023 marked a significant shift in the country’s business taxation framework. For business owners, understanding the UAE corporate tax registration deadline 2026 is not just about compliance—it’s about avoiding substantial penalties that can impact your bottom line.

Key Statistics:

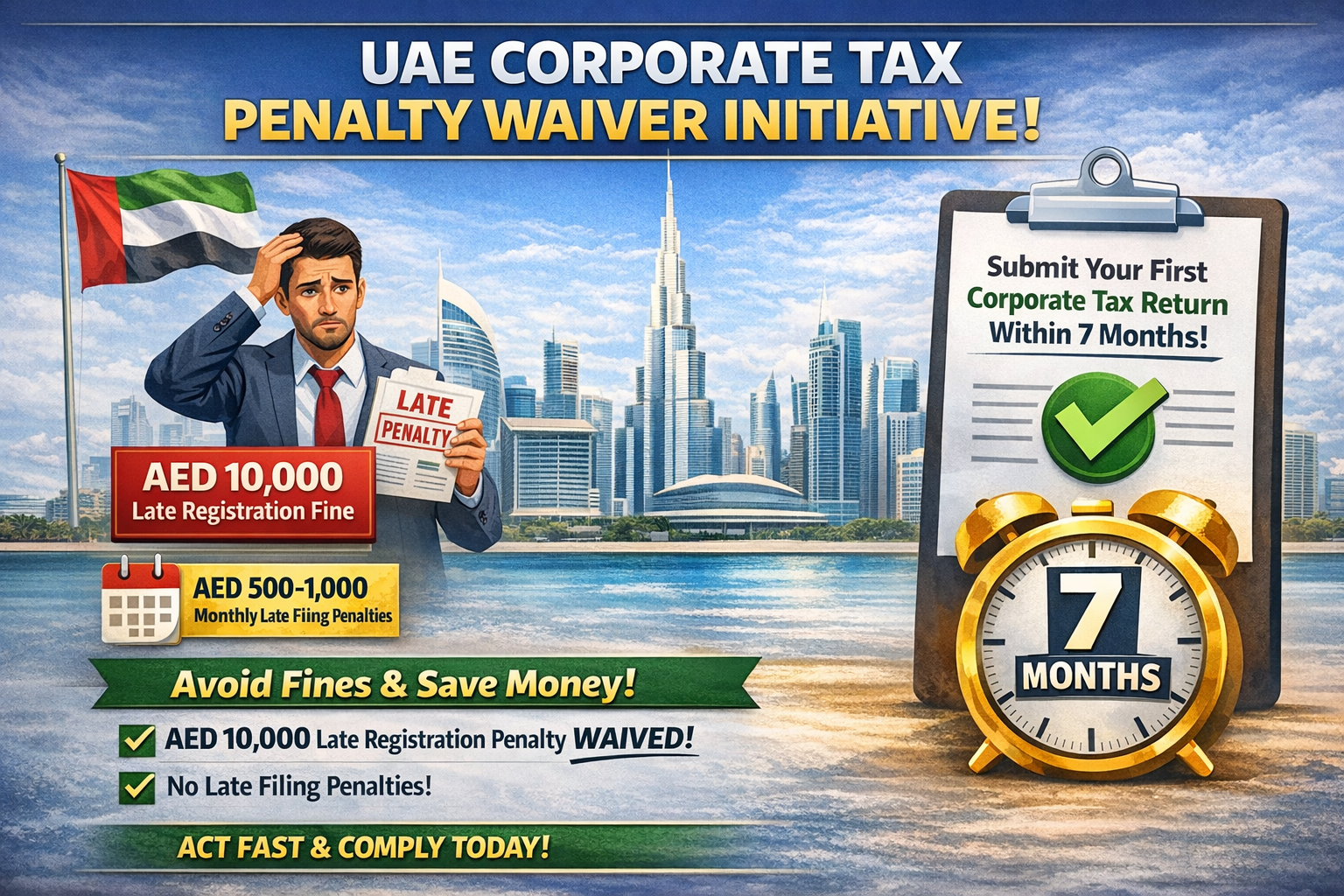

- AED 10,000 penalty for late corporate tax registration

- AED 500-1,000 monthly penalties for late filing

- 9% corporate tax rate on profits exceeding AED 375,000

- 0% tax rate on profits up to AED 375,000

Whether you’re a mainland company, free zone entity, or a natural person conducting business in the UAE, this guide provides everything you need to know about corporate tax registration deadlines, requirements, and penalties for 2026.

What is the UAE Corporate Tax Registration Deadline for 2026?

Registration Deadlines by Business Type

The UAE corporate tax registration deadline varies depending on your business type and incorporation date. Here’s the complete breakdown:

1. For Companies Incorporated On or After March 1, 2024

| Incorporation Date | Registration Deadline |

|---|---|

| January 1, 2026 | March 31, 2026 |

| April 1, 2026 | June 30, 2026 |

| July 1, 2026 | September 30, 2026 |

| October 1, 2026 | December 31, 2026 |

Rule: Companies must register within 3 months from the date of incorporation or establishment.

2. For Companies Incorporated Before March 1, 2024

These companies should have already registered. If you haven’t:

- Immediate registration required

- Penalties may already apply

- Contact the FTA or a tax consultant urgently

3. For Natural Persons (Individuals)

| Condition | Registration Deadline |

|---|---|

| Revenue exceeds AED 1 million in a calendar year | Within specified timeframe based on notification |

Note: Salary, private investment income, and real estate investment income are excluded from revenue calculations.

4. For Non-Resident Persons

| Scenario | Registration Deadline |

|---|---|

| Permanent Establishment (PE) in UAE | Within 6 months of establishing the PE |

| Nexus in UAE | Within 3 months of establishing the nexus |

Corporate Tax Filing Deadlines for 2026

Understanding the 9-Month Rule

Once registered, businesses must file their corporate tax return within 9 months from the end of their financial year.

| Financial Year End | Filing Deadline |

|---|---|

| December 31, 2025 | September 30, 2026 |

| March 31, 2026 | December 31, 2026 |

| June 30, 2026 | March 31, 2027 |

| September 30, 2026 | June 30, 2027 |

Example Timeline for Calendar Year Companies

Financial Year: January 1, 2025 - December 31, 2025

Tax Return Filing Deadline: September 30, 2026

Payment Due Date: September 30, 2026How to Register for Corporate Tax in UAE: Step-by-Step Process

Step 1: Prepare Required Documents

Before starting the registration process, ensure you have:

For Companies:

- Valid Trade License (including branch licenses if applicable)

- Certificate of Incorporation

- Memorandum of Association (MOA) or Partnership Agreement

- Emirates ID and passport of owners holding 25%+ ownership

- Emirates ID and passport of authorized signatories

- Proof of authorization for signatories (Power of Attorney or Board Resolution)

For Natural Persons:

- Emirates ID and passport

- Proof of business activity

- Financial records showing revenue

Step 2: Access the EmaraTax Portal

- Visit the official FTA EmaraTax portal

- Create an account or log in with existing credentials

- Complete UAE Pass verification if required

Step 3: Complete the Registration Application

- Select “Corporate Tax Registration” from the dashboard

- Accept the registration guidelines

- Enter entity details:

- Entity type (LLC, Free Zone Company, etc.)

- Business activities as per trade license

- Ownership details (for 25%+ shareholders)

- Add branch information if applicable

- Enter contact details and registered address

- Add authorized signatory information

Step 4: Review and Submit

- Carefully review all entered information

- Declare that all information is accurate and complete

- Submit the application

Step 5: Receive Your CTRN

- The FTA typically processes applications within 20 business days

- Upon approval, you’ll receive a Corporate Tax Registration Number (CTRN)

- This number must be included in all future tax filings and communications

UAE Corporate Tax Penalties: What Happens If You Miss Deadlines?

Late Registration Penalties

| Violation | Penalty Amount |

|---|---|

| Failure to register within the deadline | AED 10,000 |

Important Update: The FTA has announced a penalty waiver initiative for businesses that submit their first corporate tax return within 7 months from the end of their first tax period.

Late Filing Penalties

| Delay Period | Monthly Penalty |

|---|---|

| First 12 months | AED 500 per month |

| From 13th month onward | AED 1,000 per month |

Note: Even a one-day delay counts as a full month for penalty purposes.

Late Payment Penalties

| Delay Period | Penalty |

|---|---|

| First month | 2% of unpaid tax |

| Second month | 4% of unpaid tax (cumulative) |

| After 6 months | 1% daily penalty up to 300% |

Other Administrative Penalties

| Violation | Penalty |

|---|---|

| Failure to maintain proper records | AED 10,000 |

| Failure to submit required documents | AED 1,000 per instance |

| Incorrect information submission | AED 3,000 for first instance |

| Repeated incorrect submission | AED 5,000 |

Who Must Register for UAE Corporate Tax?

Mandatory Registration Required For:

- UAE Resident Juridical Persons

- All companies incorporated in UAE

- Free zone companies

- Branches of foreign companies

- Non-Resident Persons with UAE Connection

- Permanent Establishment in UAE

- Nexus in UAE

- UAE-sourced income

- Natural Persons Conducting Business

- Annual revenue exceeding AED 1 million

- Excludes: Salary, private investments, real estate

Exemptions from Corporate Tax:

- Government entities

- Government-controlled entities

- Qualifying public benefit entities

- Extractive businesses (subject to conditions)

- Non-extractive natural resource businesses (subject to conditions)

Corporate Tax Rates in UAE (2026)

Standard Tax Rates

| Taxable Income | Rate |

|---|---|

| Up to AED 375,000 | 0% |

| Above AED 375,000 | 9% |

Special Rates

| Category | Rate |

|---|---|

| Qualifying Free Zone Person (Qualifying Income) | 0% |

| Qualifying Free Zone Person (Non-Qualifying Income) | 9% |

| Large multinationals (subject to OECD Pillar Two) | 15% |

Small Business Relief: Important Update for 2026

Eligibility Criteria

Businesses with revenue of AED 3 million or less can elect for Small Business Relief:

- Must be a Resident Person

- Revenue ≤ AED 3,000,000 in current tax period

- Revenue ≤ AED 3,000,000 in all previous tax periods

- Must elect for each tax period separately

Benefits of Small Business Relief

- Treated as having no taxable income

- No corporate tax payable

- No transfer pricing documentation required

- Simplified compliance

Who Cannot Claim Small Business Relief?

- Qualifying Free Zone Persons

- Members of multinational groups with consolidated revenue > AED 3.15 billion

Free Zone Companies: Special Registration Considerations

Qualifying Free Zone Person (QFZP) Requirements

To maintain 0% tax rate on qualifying income:

- Maintain adequate substance in the Free Zone:

- Physical office space

- Local staff and operations

- Genuine business activity

- Earn only Qualifying Income

- Comply with transfer pricing rules

- File annual corporate tax returns (mandatory even if tax is zero)

Free Zone Registration Deadline

Same as mainland companies:

- Incorporated on/after March 1, 2024: Within 3 months of incorporation

- Must register regardless of tax rate (even if 0%)

Frequently Asked Questions (FAQ)

Q1: What happens if I miss the corporate tax registration deadline?

A: You’ll face an immediate penalty of AED 10,000. Additionally, late filing penalties of AED 500-1,000 per month will apply. The FTA may also conduct compliance reviews and delay future filings.

Q2: Can I register for corporate tax after the deadline?

A: Yes, but penalties will apply. The FTA has announced a waiver initiative if you submit your first tax return within 7 months from the end of your first tax period.

Q3: Do free zone companies need to register for corporate tax?

A: Yes. All free zone companies must register for corporate tax, even if they qualify for 0% tax rate. Registration is mandatory; the tax rate depends on meeting QFZP conditions.

Q4: How long does corporate tax registration take?

A: The FTA typically processes complete applications within 20 business days. Incomplete applications may take longer.

Q5: What is the difference between registration deadline and filing deadline?

A:

- Registration deadline: When you must register with the FTA (within 3 months of incorporation for new companies)

- Filing deadline: When you must submit your tax return (within 9 months of financial year-end)

Q6: Do I need to register if my company is dormant?

A: Generally, dormant companies that have not conducted business may not need to register. However, consult the FTA or a tax advisor for your specific situation.

Q7: Can I complete corporate tax registration myself?

A: Yes, the entire process is online through the EmaraTax portal. However, many businesses prefer to work with tax consultants to ensure accuracy and compliance.

Q8: What documents do I need for corporate tax registration?

A: Required documents include:

- Valid trade license

- Certificate of incorporation

- MOA/Partnership agreement

- Emirates ID and passport of shareholders (25%+)

- Authorized signatory details

- Proof of authorization

Q9: Is corporate tax registration different from VAT registration?

A: Yes, they are separate registrations. You may need to register for both depending on your business activities and revenue thresholds.

Q10: What is the penalty waiver initiative?

A: The FTA will waive the AED 10,000 late registration penalty if you submit your first corporate tax return within 7 months from the end of your first tax period.