UAE tax compliance checklist 2025

Stay ahead of VAT and Corporate Tax regulations with this practical guide

The UAE has introduced robust tax regulations to strengthen financial transparency. Whether you’re a business owner, freelancer, or investor, here’s your essential tax compliance checklist with deadlines to avoid penalties and ensure smooth operations:

✅ 1. Trade License & Business Information

Keep your trade license active and renewed annually.

Update FTA records within 20 business days if there’s any change in:

Legal name

Business activity

Address

Ownership or legal structure

Emirates ID or passport details

- Any other renewal / update in the business or business owners / managers information

Penalty for non-compliance: AED 5,000

✅ 2. VAT Compliance

Register for VAT within 30 days if your taxable turnover exceeds AED 375,000.

File VAT returns quarterly or monthly based on your VAT certificate.

VAT return due: 28th of the following month after tax period ends

Issue valid tax invoices for all taxable sales.

Maintain VAT-compliant books and reconcile input/output VAT monthly.

Deregister if turnover drops below AED 187,500 or business ceases.

VAT deregistration must be filed within 20 business days of eligibility.

✅ 3. Corporate Tax Compliance

Corporate Tax registration is mandatory for all UAE businesses (including freelancers if revenue is more than AED 1 million in a calendar year).

Deadline: Within 3 months from the date of trade license issuance

File Corporate Tax Return within 9 months from the end of your financial year.

Example: If year ends on 31 December 2024 → return due by 30 September 2025

Prepare and retain audited financial statements (required for companies with revenue > AED 50M).

Disclose related party and connected person transactions if total exceeds AED 500,000 annually.

✅ 4. Bookkeeping & Record Retention

Keep accounting records e.g. invoices, delivery notes, communications, VAT documents, and tax returns for at least 7 years.

Ensure your accounting system is FTA-compliant and audit-ready.

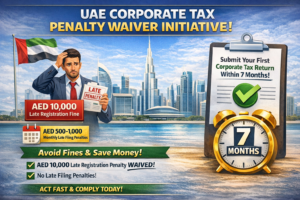

✅ Penalties to Watch For:

| Non-Compliance Area | Penalty Amount |

|---|---|

| Late VAT return filing | AED 1,000 – AED 2,000 |

| Failure to update FTA records | AED 5,000 |

| Delay in corporate tax registration | AED 10,000 |

| Improper record keeping | AED 10,000+ |

📝 Final Tip

Regularly reviewing your tax obligations and deadlines can save you from costly penalties. Consider conducting quarterly internal reviews or engaging a professional to ensure complete compliance.